In 2017, former Flipkart CTO Ravi Garikipati was responsible for the e-commerce group’s financial technology initiatives. He went on to seed many financial initiatives on the e-commerce platform, including Flipkart’s Buy Now Pay Later scheme, cardless EMI, and a unique mobile protection insurance product. These products focused on pushing affordability and consumption, and led Ravi to think about the “bottom of the pyramid”. He began to think of ways on how technology could assist in financial inclusion.

After almost four years at Flipkart (three as its CTO), Ravi decided to hang up his boots at the e-commerce major. The “what next” question had a couple of answers: joining a venture capital fund or starting one of his own to invest and mentor deep tech initiatives. But, the idea of starting something in the financial inclusion space kept cropping up. And, in April 2019, Ravi applied for an NBFC licence to start Davinta Financial Services, a technology-focused umbrella NBFC for the underserved, including the rural, urban, and micro-entrepreneur segments.

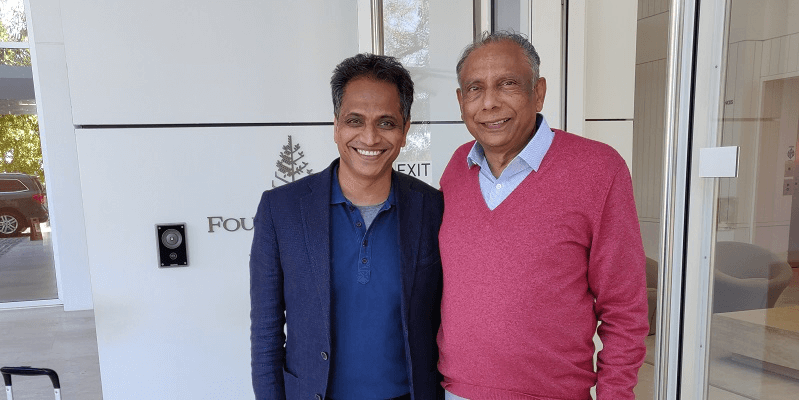

While conceptualising his Bengaluru-based startup, Ravi got in touch with long-time friend and serial entrepreneur Raj Vattikuti. Based out of Michigan, Raj’s first company Covansys was acquired by Computer Sciences Corporation for $1.3 billion. He has been involved in philanthropic work in India on “alleviating poverty and increasing quality of life at the bottom of the pyramid”, and also founded the Poverty Alleviation Initiative. Ravi’s technology prowess and Raj’s acumen for understanding the needs of the bottom of the pyramid seemed to be the perfect pairing to serve the underserved. Providing for the ‘bottom of the pyramid’ A technology-focused NBFC for the underserved, Davinta Finserv focuses on three segments: rural, urban, and micro entrepreneurs. However, unlike most other models today, Ravi explains that Davinta differentiates itself by providing loans not for consumption, but to create a sustainable financial ecosystem by increasing livelihood opportunities for the borrower. In rural areas, Davinta does this by fleshing out livelihood opportunities; it partners with NGOs working on-ground to help create income-generating opportunities. Once there is a clear plan, the startup provides loans to borrowers to increase their income. The startup also partners with brand retailers to provide direct sourcing from its borrower ecosystem. One example is organic milk retailer Akshaykalpa, which sources from dairy farmers who have availed working capital from Davinta. Ravi says that creating this ecosystem ensures higher earnings for farmers.

…